- Galway: 091 - 421900 Cork: 021 - 4190009 Dublin: 01 - 5311386

- Unit 22 Claregalway Corporate Park, Claregalway, Co Galway H91 NWK7

Leaders in Financial Consultancy

- Personal & Business Planning

- Pension Encashment

- Redundancy Advice

- Early Retirement

- International Options

- E.U Residency and tax regimes

All your Questions on Personal and Business Finances answered

Q Money Financial Consultants Ltd are Financial Consultants advising Individuals, Executives and Companies. Q Money specialise in Financial Planning, Tax Efficient solutions Retirement/Pension Exit mechanisms for Individuals, Self Employed and Company Directors in Ireland, U.K and the E.U.

Whether you want to start a financial plan, retirement plan or cash-in a Pension fund, we can advise and construct a tax-efficient model that suits your needs in Retirement. Our Experienced and Qualified Financial Consultants can help you today.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Which Service Interests you?

Your Pension Release options start here. We can help you to claim tax free cash from your pension before the age of 65. If you have a pension in a former employers scheme or you are considering early retirement options, our experienced team will focus on your individual needs, pension and retirement options.

Contact us and we will cut through all the complicated language and red tape. A highly experienced Advisor and an energetic, prompt and efficient service will be working for you TODAY.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

If you are a member of a large private or company scheme and are being given “the run-around” on your precise entitlements or are experiencing difficulty with a pension provider or Fund Administrator, contact us now and we will take on that claim process and a Qualified Pension Advisor will help you immediately!

Request a Free Review or Call Today

Dublin: 01-5311386 Galway: 091-421900 Cork: 021-4190009

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Are you considering redundancy and need specific advice? Get Independent Advice on your Redundancy Entitlements and Options. Experienced Financial consultants are on hand now to evaluate Employers’ redundancy offers. We will examine your entitlements as well as the impact of any payment on your taxation or pension status.

Where you lose your job due to circumstances such as the closure of the business or a reduction in the number of staff this is known as redundancy.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Don’t let your UK Pension get Locked in!

The UK will leave the EU legally at the end of 2020. If you have a UK Employer or Personal Pension and now reside or intend residing in the EU in future, you need to take steps to secure future benefits, NOW.

The UK government will no longer be obliged to follow current QROP legislation between EU states. There may be withholding taxes applied to taking your pension to another jurisdiction. An Experienced International Pension Consultant is on hand to give immediate advice and set about securing your UK Pension Benefits TODAY.

Request a Free Review or Call Today

Cork: 021-4190009 Dublin: 01-5311386 Galway: 091-421900

You may have a private or employer pension in Ireland or the UK. There may be more tax-efficient retirement or pension access options available to you elsewhere in the EU.

Eg. Portugal and Malta have very generous treatment of Pensions from other EU states.

An experienced International Financial Consultant is available to review all of your pension options, evaluate your situation and advise on a tax fully regulated and efficient retirement pathway in each potential jurisdiction.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

You may have built up a private pension fund in Ireland or be considering when, how and where you might start enjoying your money. Portugal has introduced very generous tax rates for pension income received in Portugal from other EU Countries. It may be possible to achieve NHR status and receive your pension proceeds at a flat tax rate of 10% on post Tax Free Lump sum drawdowns.

Special tax rates may also apply to certain classes of Professional Income received in Portugal.

An experienced team of International Retirement and Tax Consultants are ready to evaluate your case and guide you through the optimum International pathway in tax efficiency.

Request a Free Review or Call Today

Cork: 021-4190009 Galway: 091-421900 Dublin: 01-5311386

Why Malta? Malta is a respected, English-speaking financial centre with robust overseas pension scheme legislation. Malta has the unique advantage of being a member of the commonwealth, whilst having security of being a full member of the European Union. Benefits

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Self Administered Pensions are available to some Professionals, Company Directors and Investors. The key attraction is that the Pensioner gets to choose their own investment assets in the fund. It is very common for people with knowledge of investment properties to acquire commercial or buy to let properties in their pensions.

There are strict Revenue and Regulatory guidelines associated with the type of property and investments which are permitted in this type of pension vehicle. An experienced Consultant will evaluate your potential investment scenario and the tax efficiency implications for you TODAY.

Request a Free Review or Call Today

Galway: 091-421900 Dublin: 01-5311386 Cork: 021-4190009

What’s your status?

- Transferring fund value to a Personal Retirement Bond.

- You may wish to compile all of your previous Employer pensions in Personal Retirement Bonds from which you may be able to take early retirement benefits and extract tax free cash.

- You may wish to transfer a previous pension to a current Employers scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Typically, a number of week payment per year of Employment i.e. Statutory Entitlements.

- An Ex- Gratia payment from the Employer.

- Access to a higher Tax-free lump sum by taking some Tax-free cash from the Pension of the Employee.

- A voluntary waiver of one’s Tax-free Pension entitlements.

- Restriction on the Employee taking maximum Tax-free cash from their pension early. (Age 50).

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Policy Charges

- Fees

- Fund performance comparison.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Property

- Stocks and Shares

- Bespoke Investment classes.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Transferring to a Personal Retirement Bond (With a Life Company).

- Taking Early Retirement Options (Depending on age and health).

-

- Tax Free Cash Extractions (Depending on age and circumstance).

- Transferring to a new Employer’s scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

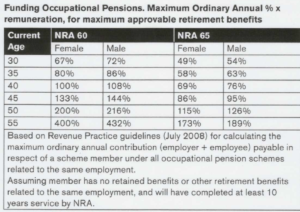

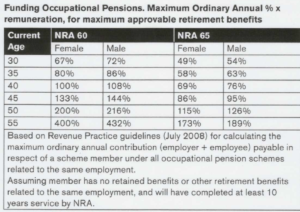

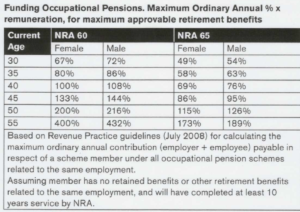

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Request a Free Review or Call Today

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386