- Galway: 091 - 421900 Cork: 021 - 4190009 Dublin: 01 - 5311386

- Unit 22 Claregalway Corporate Park, Claregalway, Co Galway H91 NWK7

Self-Administered Pension Options

Self-Administered Pension Options

Self Administered Pension Options are available to some Professionals, Company Directors and Investors. The key attraction is that the Pensioner gets to choose their own investment assets in the fund. It is very common for people with knowledge of investment properties to acquire commercial or buy to let properties in their pensions.

There are strict Revenue and Regulatory guidelines associated with the type of property and investments which are permitted in this type of pension vehicle. An experienced Consultant will evaluate your potential investment scenario and the tax efficiency implications for you TODAY.

Why Us

- FREE Tax Efficiency Assessment Today

- Experienced International Advisors

- Immediate Review by Pension Consultant

- Tax Free Early Pension Advice

- Pension Release Advice

- Fast Pension Advice Service

- Review your Pension Options

How We Can Help

If you have created a reasonable value in your pension fund and want to become involved in investments in specific asset classes where you may be able to contribute some expertise of your own, then a S.S.A.S may work for you.

With a S.S.A.S, you appoint a professional Trustee to guide you on matters of compliance. You can largely make your own investment decisions, such as purchasing property, shares or other investments within your pension (Subject to certain rules, regulations and restrictions).

There is no Capital Gain Tax payable on investment gains or rental income within the S.S.A.S and withdrawals are subject to the normal retirement taxation criteria based on age and income.

A S.S.A.S can be a good method for someone with investments property expertise to build up a good pension pot within a scheme in a tax efficient manner. There are several important restrictions on the properties purchased, rented or sold by S.S.A.S scheme and S.A.S pension holders are advised to contact our advisors at the outset before considering acquiring any pension assets.

Contact us to discuss your options further. We will have an experienced S.S.A.S Pension Advisor get in touch with you within 24 hours to explore your options for a tax-efficient Pension mechanism.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

1. Firstly, request a FREE review using the form above, during which your situation will be assessed by an Independent Qualified Financial Adviser who will contact you within 24 hours.

2. If you are eligible, your appointed Independent Qualified Financial Advisor will inform you of the maximum sum you can release. If you are happy to proceed the Independent Qualified Advisor’s process of releasing your Pension will begin.

3. The Financial Advisor will complete a full fee and fund performance comparison across all regulated pension providers in Ireland. When the pension release process is complete you will receive a lump sum payment for you to do with as you wish.

Request a Free Review or Call Today

Dublin: 01-5311386 Galway: 091-421900 Cork: 021-4190009

Leaders in Financial Consultancy

Q Money Financial Consultants Ltd are Financial Consultants advising Individuals, Executives and Companies. Q Money specialise in Financial Planning, Tax Efficient solutions Retirement/Pension Exit mechanisms for Individuals, Self Employed and Company Directors in Ireland, U.K and the E.U.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

What’s your status?

- Transferring fund value to a Personal Retirement Bond.

- You may wish to compile all of your previous Employer pensions in Personal Retirement Bonds from which you may be able to take early retirement benefits and extract tax free cash.

- You may wish to transfer a previous pension to a current Employers scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Typically, a number of week payment per year of Employment i.e. Statutory Entitlements.

- An Ex- Gratia payment from the Employer.

- Access to a higher Tax-free lump sum by taking some Tax-free cash from the Pension of the Employee.

- A voluntary waiver of one’s Tax-free Pension entitlements.

- Restriction on the Employee taking maximum Tax-free cash from their pension early. (Age 50).

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Policy Charges

- Fees

- Fund performance comparison.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Property

- Stocks and Shares

- Bespoke Investment classes.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Transferring to a Personal Retirement Bond (With a Life Company).

- Taking Early Retirement Options (Depending on age and health).

-

- Tax Free Cash Extractions (Depending on age and circumstance).

- Transferring to a new Employer’s scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

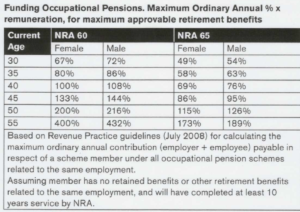

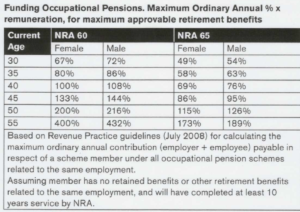

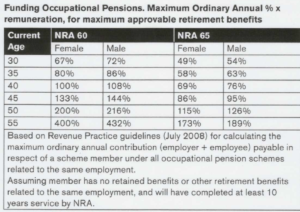

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Request a Free Review or Call Today

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386