- Galway: 091 - 421900 Cork: 021 - 4190009 Dublin: 01 - 5311386

- Unit 22 Claregalway Corporate Park, Claregalway, Co Galway H91 NWK7

Retire Tax-Free

We can help you to claim tax free cash from your pension before the age of 65. If you have a pension in a former employers scheme or you are considering early retirement options, our experienced team will focus on your individual needs, pension and retirement options.

Contact us and we will cut through all the complicated language and red tape. A highly experienced Advisor and an energetic, prompt and efficient service will be working for you TODAY.

Why Us

- Experienced International Advisors

- FREE Tax Efficiency Assessment Today

- Immediate Review by Pension Consultant

- Tax Free Early Pension Advice

- Pension Release Advice

- Fast Pension Advice Service

- Review your Pension Options

How We Can Help

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

1. Firstly, request a FREE review using the form above, during which your situation will be assessed by an Independent Qualified Financial Adviser who will contact you within 24 hours.

2. If you are eligible, your appointed Independent Qualified Financial Advisor will inform you of the maximum sum you can release. If you are happy to proceed the Independent Qualified Advisor’s process of releasing your Pension will begin.

3. The Financial Advisor will complete a full fee and fund performance comparison across all regulated pension providers in Ireland. When the pension release process is complete you will receive a lump sum payment for you to do with as you wish.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Why would I transfer my pension to Portugal?

You may be able to get Non-Habitual Residency status there and avail of Irish or E.U. Pension Payments tax-free.

Are pensions taxed in Portugal?

Under the Ireland/Portugal tax treaty, Irish State Pension and most other pension income is taxable only in Portugal. As it comes from a foreign source, this makes it tax-free for non-habitual residents.

Since 2009 and the introduction of the Non-Habitual Residence (NHR) tax regime, Portuguese authorities have been enticing high net worth individuals and families to relocate their status to Portugal using significantly beneficial tax treatment for the first ten years that they hold in NHR status in Portugal.

While this may sound like the preserve of the super-rich, that isn’t always the case and Portugal has a tax system which is very efficient for those currently in certain types employment, as well as retirees who either live there or might be planning to live there, on an income from private pensions from outside Portugal.

Many Irish and UK Retirees are now retiring to Portugal, sometimes through other tax Friendly EU countries such as Malta.

What is Non-Habitual Residency status (NHR)?

The Non-Habitual Residence status was introduced in Portugal to offer people a legitimate way to earn, save and receive Pension payments and invest in Portugal without paying tax on certain forms of income like inheritance, the disposal of assets and pension income.

Introduced in 2009 and renewed by the Portuguese Government last year, being granted NHR status ensures that for ten years, people who are accepted for Non-Habitual Residency status can essentially receive certain incomes free of tax both in Portugal and in the country of the income source.

Why can’t I do this in Ireland? Or just go straight to Portugal?

The Non-Habitual Residency regime could be especially beneficial for retirees as income which is received from pensions overseas is not taxed in Portugal on the basis that it has normally been taxed at source (i.e. the location of the pension). i.e. If Pension payments are coming from a Tax-Free source of Origin (e.g. Malta), then there is no additional taxation payable to a person with Non-Habitual Residency status in Portugal.

The tax-free Pension solution.

Applying for Non-Habitual Residence/ Status;

If an individual wants to apply for Non-Habitual Residence status in Portugal, there are a number of simple requirements which must be met as a minimum including:

- You must not have been resident in Portugal already (for the previous five tax years)

- You must own (or be renting) a property in Portugal at the time of the application with a minimum forward lease term of 6 months.

- You can acquire a Portuguese Bank Account once Non-Habitual Residency has been approved by the Portuguese authorities.

While the process (provided it is processed correctly from a legal and regulatory standpoint) can be relatively straightforward, it does take time. To maximise your chances of becoming a Non-Habitual Resident, it is vital that you seek our expert advice at the beginning of the process.

We will establish the contacts and consultations you need within Portugal;

- Financial Advisors (NHR Application Agents)

- Property Consultants

- Lawyers

- Banks

To ensure that the process goes smoothly, contact us today to design your pathway to;

Tax Free Pension Cash in Portugal

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In the case of dependent or independent work, the applicable tax rate is 20%.

Taxation applies to income derived from high added value activities of a scientific, artistic or technical nature:

- Architects, engineers and similar technicians

- Fine artists, actors and musicians

- Auditors

- Doctors and dentists

- Teachers

- Psychologists

- Liberal professions, technicians and similar

- Senior managers

- Investors, directors and managers

Registration as a Non-Habitual Resident confers the right to be taxed as such for a period of 10 years as from the year of registering as a tax resident in Portuguese territory.

Once Non-Habitual Resident Status has been obtained, in which cases is foreign income obtained by Non-Habitual Residents in Portugal exempt from taxation?

In the case of pensioners and retired people when:

- Income is taxed in the source State, in accordance with the convention to eliminate double taxation, signed by Portugal and that State; or

- Income is not considered to have been obtained through a Portuguese source, according to the criteria provided for in the IRS Code (personal income tax).

In the case of income derived from employment, when:

- Income is taxed in the State of origin, in accordance with the convention to eliminate double taxation, signed by Portugal and that State; or

- That income is taxed in another State with which Portugal has not signed any convention to eliminate double taxation, as long as the income is not considered to have been obtained in Portuguese territory, in accordance with the criteria in article 18 of the IRS Code (personal income tax);

In the case of income from self-employment (through the provision of services of a high added value, of a scientific, artistic or technical nature, or through intellectual or industrial property, investment income, rental income, capital gains income or other increases in equity), when:

- The income may be taxed in the source country, territory or region, in accordance with the convention to eliminate double taxation, or;

- When no convention to eliminate double taxation has been signed, the OECD model convention may be applied (taking into consideration the observations and reservations made by Portugal) and as long as the source country, territory or region does not have a privileged tax regime, and as long as the income is not considered to have been obtained in Portuguese territory, in accordance with the criteria in article 18 of the IRS (personal income tax).

Request a Free Review or Call Today

Dublin: 01-5311386 Galway: 091-421900 Cork: 021-4190009

1. Firstly, request a FREE review using the form above, during which your situation will be assessed by an Independent Qualified Financial Adviser who will contact you within 24 hours.

2. If you are eligible, your appointed Independent Qualified Financial Advisor will inform you of the maximum sum you can release. If you are happy to proceed the Independent Qualified Advisor’s process of releasing your Pension will begin.

3. The Financial Advisor will complete a full fee and fund performance comparison across all regulated pension providers in Ireland. When the pension release process is complete you will receive a lump sum payment for you to do with as you wish.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Ability to retire at an age to suit you and take benefits in a form that is more beneficial to you.

- Access to a wide range of investment opportunities.

- Tax Efficient – Malta has around 70 Double Tax Treaties (DTA’s), for residents of countries that have a DTA with Malta.

- No Tax to pay on assets within scheme (with exception of immovable property in Malta).

- Can nominate beneficiaries on your pension.

- No charge on the lifetime allowance fund.

- Inheritance benefits – you can pass on your pension pot to your beneficiary upon death free of IHT (Inheritance Tax Free).

- You can combine various smaller pensions into one large pot resulting in only one annual management fee as well as the opportunity to benefit from the economies of scale by combining investments.

- Avoid ongoing currency exchange fees in investing in the same currency as the country you reside in or in any currency of your choice.

- Avoid the risk of political and regulatory uncertainty at home. “Another crash! Another Brexit”. Protect your retirement fund from another fiducial collapse in the Irish Financial system.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Up to 30% lump sum available when drawdown commences.

- Fund growth is Tax Free.

- Ability to retire at an age to suit you and take benefits in a form that is best for the member.

- Available to all nationalities with accrued UK pensions, leaving or having already left the UK.

- Access to a wide range of investment opportunities free from income or capital gains tax.

- For residents of countries that have a Double Tax Treaty (DTA) with Malta, this means it can pay pension income gross in accordance with HMRC’s requirements.

- Inheritance benefits under the pension scheme can be paid free of inheritance tax in the UK or Malta.

- You can combine various smaller pensions into one large pot.

- Avoid ongoing currency exchange fees in investing in the same currency as the country you reside in or in any currency of your choice.

- Flexi-Access Drawdown available from the age of 55.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

1. Firstly, request a FREE review using the form above, during which your situation will be assessed by an Independent Qualified Financial Adviser who will contact you within 24 hours.

2. If you are eligible, your appointed Independent Qualified Financial Advisor will inform you of the maximum sum you can release. If you are happy to proceed the Independent Qualified Advisor’s process of releasing your Pension will begin.

3. The Financial Advisor will complete a full fee and fund performance comparison across all regulated pension providers in Ireland. When the pension release process is complete you will receive a lump sum payment for you to do with as you wish.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Leaders in Financial Consultancy

Q Money Financial Consultants Ltd are Financial Consultants advising Individuals, Executives and Companies. Q Money specialise in Financial Planning, Tax Efficient solutions Retirement/Pension Exit mechanisms for Individuals, Self Employed and Company Directors in Ireland, U.K and the E.U.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

What’s your status?

- Transferring fund value to a Personal Retirement Bond.

- You may wish to compile all of your previous Employer pensions in Personal Retirement Bonds from which you may be able to take early retirement benefits and extract tax free cash.

- You may wish to transfer a previous pension to a current Employers scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Typically, a number of week payment per year of Employment i.e. Statutory Entitlements.

- An Ex- Gratia payment from the Employer.

- Access to a higher Tax-free lump sum by taking some Tax-free cash from the Pension of the Employee.

- A voluntary waiver of one’s Tax-free Pension entitlements.

- Restriction on the Employee taking maximum Tax-free cash from their pension early. (Age 50).

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Policy Charges

- Fees

- Fund performance comparison.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Property

- Stocks and Shares

- Bespoke Investment classes.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Transferring to a Personal Retirement Bond (With a Life Company).

- Taking Early Retirement Options (Depending on age and health).

-

- Tax Free Cash Extractions (Depending on age and circumstance).

- Transferring to a new Employer’s scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

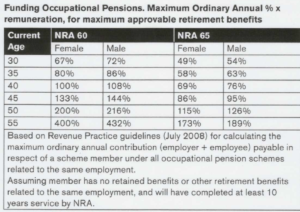

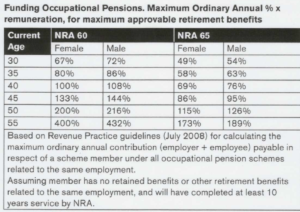

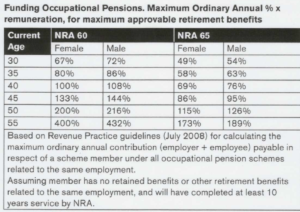

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Request a Free Review or Call Today

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386