- Galway: 091 - 421900 Cork: 021 - 4190009 Dublin: 01 - 5311386

- Unit 22 Claregalway Corporate Park, Claregalway, Co Galway H91 NWK7

Redundancy Advice

Redundancy Advice

Are you considering redundancy and need specific advice? Get Independent Advice on your Redundancy Entitlements and Options. Experienced Financial consultants are on hand now to evaluate Employers’ redundancy offers. We will examine your entitlements as well as the impact of any payment on your taxation or pension status.

Where you lose your job due to circumstances such as the closure of the business or a reduction in the number of staff this is known as redundancy.

The redundancy payments act 1967 – 2014 provide a minimum entitlement to a redundancy payment for employees who have a set period of service with the employer. Not all employees are entitled to the statutory redundancy payment, even where a redundancy situation exists. If you do qualify for redundancy there are specific redundancy procedures which employers and employees must follow in order to comply with the legislation.

For Independent Advice, call today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Employer Discretionary Payments (Top - ups)

However, you and your employer may agree to a redundancy payment above the statutory minimum, and in such circumstances, employees who have not reached the statutory minimum period of service may also receive a payment. For example, statutory redundancy only applies to employees with two years’ service. This Employer payment arises through agreement and not through a statutory entitlement. As so often in employment law, the legislation is concerned with ensuring minimum rights, while allowing the parties to agree more substantial rights.

Frequently Asked Questions

Not all employees are entitled to the statutory redundancy payment, even where a redundancy situation exists. To be eligible for a payment under the Redundancy Acts, the employee must satisfy the following requirements.

- Be aged over 16 years of age

- Be in employment that is insurable for all benefits under the social welfare system (PRSI Class A)

- Have worked continuously for the employer for at least 104 weeks

- Have been in continuous employment for more than two years if a part-time worker

- The same rules apply to apprentices. Apprentices qualify for redundancy unless they are let go within one month of completing an apprenticeship.

If you require Independent Advice on qualifying for statutory redundancy or you are assessing a redundancy offer from your employer, contact us for full analysis and advice on your options. Complete the data box above and an Experienced Financial Advisor will contact you within 24 hours to assess your payments, pension and taxation implications.

For Independent Advice, call today

Cork: 021-4190009 Galway: 091-421900 Dublin: 01-5311386

The statutory redundancy payment is a lump-sum payment based on the pay of the employee. All eligible employees are entitled to:

- Two weeks’ pay for every year of service they have since they were 16 and

- One further week’s pay

The amount of statutory redundancy is subject to a maximum earnings limit of €600 per week (€31,200 per year)

Pay refers to your current normal weekly pay including average regular overtime and benefits-in-kind, but before tax and PRSI deductions, that is your gross pay.

The statutory redundancy payment is tax-free.

You can get an Independent Redundancy rule-check within 24 hours by calling.

For Independent Advice, call today

Dublin: 01-5311386 Cork: 021-4190009 Galway: 091-421900

All redundancies notified after 10 April 2005 take account of absences from work over the last 3 years of service. Any absences outside of this 3-year period which ends on the date of termination of employment are disregarded. When calculating the actual length of your service for redundancy payment purposes, the following are regarded as reckonable service, (the absences listed here are called reckonable absences):

- The period you were actually in work

- Any absence from work due to holidays

- Any absence from work due to illness (see below for non-reckonable periods of illness)

- Any period where you were absent from work by agreement with your employer (typically career break)

- Any period of basic and additional maternity leave allowed under the legislation

- Any period of basic adoptive/paternity/carer’s leave

- Any period of lock-out from your employment

- Any period where the continuity of your employment is preserved under the Unfair Dismissals Acts.

However, in making the calculations of the length of your service, the following periods over the last 3 years will not be taken into accounts as service, (these are called non-reckonable absences):

- Any period over 52 consecutive weeks where you were off work due to an injury at work

- Any period over 26 consecutive weeks where you were off work due to an illness

- Any period on strike

- Any period of lay off from work.

You can get an Independent Redundancy rule-check within 24 hours by calling.

For Independent Advice, call today

Galway: 091-421900 Dublin: 01-5311386 Cork: 021-4190009

You can use the Dept of Employment Affairs and Social Protection redundancy calculator (click here) to help you to calculate your statutory redundancy entitlements. You should note that the online redundancy calculator does not give a legal entitlement to any statutory redundancy amount.

For Independent Advice, call today

Cork: 021-4190009 Galway: 091-421900 Dublin: 01-5311386

Yes, we can. Please complete the Review panel above and an experienced consultant will be in touch with you within 24 hours to verify the entitlements and assist you with your application process. We can examine your Employer’s offer and calculate the most tax-efficient outcome from the redundancy offer.

For Independent Advice, complete the data request now or call today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

You may have received an offer from your Employer which requires your decision to accept or reject. You may be confused about taking the redundancy payment and exercising your pension tax-free lump sum allowance. This is a very important consideration on which you should take independent advice.

For Independent Advice, call today

Cork: 021-4190009 Dublin: 01-5311386 Galway: 091-421900

Tax and Pension Implications

The decision may require assessment of your tax and pension status. Our consultants will guide you through the process to arrive at the most tax-efficient outcome for your without prejudicing your pension benefits in later life.

Your employer may be presenting an apparently generous financial offer. However, the payment you accept now may have long term pension/ tax implications for you. You should avail of our independent advice before deciding or signing any employer’s offer.

For Independent Advice, call today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Leaders in Financial Consultancy

Q Money Financial Consultants Ltd are Financial Consultants advising Individuals, Executives and Companies. Q Money specialise in Financial Planning, Tax Efficient solutions Retirement/Pension Exit mechanisms for Individuals, Self Employed and Company Directors in Ireland, U.K and the E.U.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

What’s your status?

- Transferring fund value to a Personal Retirement Bond.

- You may wish to compile all of your previous Employer pensions in Personal Retirement Bonds from which you may be able to take early retirement benefits and extract tax free cash.

- You may wish to transfer a previous pension to a current Employers scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Typically, a number of week payment per year of Employment i.e. Statutory Entitlements.

- An Ex- Gratia payment from the Employer.

- Access to a higher Tax-free lump sum by taking some Tax-free cash from the Pension of the Employee.

- A voluntary waiver of one’s Tax-free Pension entitlements.

- Restriction on the Employee taking maximum Tax-free cash from their pension early. (Age 50).

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Policy Charges

- Fees

- Fund performance comparison.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Property

- Stocks and Shares

- Bespoke Investment classes.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

- Transferring to a Personal Retirement Bond (With a Life Company).

- Taking Early Retirement Options (Depending on age and health).

-

- Tax Free Cash Extractions (Depending on age and circumstance).

- Transferring to a new Employer’s scheme.

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

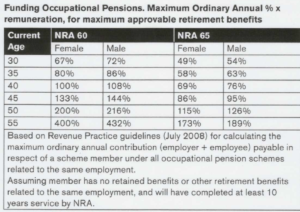

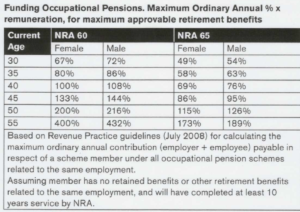

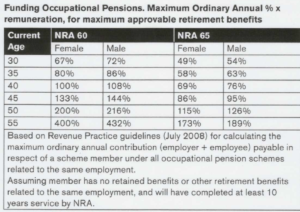

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

To ensure that you have the Maximum approvable retirement benefit from your company and Executive scheme, please request a call back or select a review below. Our Consultant will be back to you within 24 hours.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Request a Free Review or Call Today

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Request a Free Review or Call Today

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386

Galway: 091-421900 Cork: 021-4190009 Dublin: 01-5311386